26 July 2023

Forex Trading Instruments

Trading instruments are contracts for assets that can be bought, created, modified, or settled. Simply put, it is a legal agreement that involves any monetary value.

In trading instrument, it lets you profit from currency price changes in market.

Examples include currencies like the US Dollar or Euro. You can also trade futures and CFDs (Contracts for Difference).

These tools open the door to the global forex markets. They let you speculate, hedge risk, and grow your capital.

Each one is different. They have their own risks. Their own strategies. Their own advantages.

You can choose the one that fits your trading style. Whether you're careful or aggressive, there's an option for you.

Why it matters: The right instrument can make all the difference. It helps you trade smarter. It brings you closer to your goals.

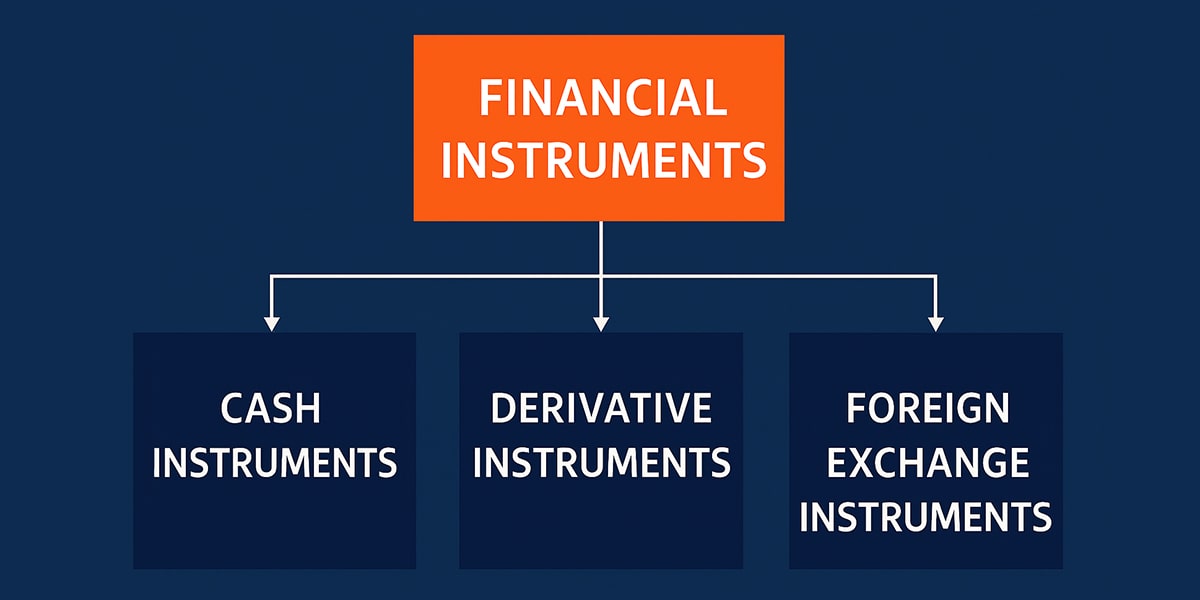

Classification Trading Instruments

There are a number of trading instruments that fall into different categories.

Cash instruments

Cash instruments are simple and direct. Their value depends on current financial markets conditions.

Securities like stocks and bonds are popular. When you buy a stock market, you own part of a company.

Loans and deposits are also cash instruments. They are agreements between lenders and borrowers.

These instruments are easy to understand and widely used.

Derivative instruments

Derivatives get their value from other assets. These assets can include:

- ◉ Stocks

- ◉ Currencies

- ◉ Commodities

- ◉ Bonds

- ◉ Indices

Common types of derivatives:

Futures Р Agreements to buy or sell at a fixed price on a future date.

They give the right, not the obligation, to trade at a set price.

Derivatives serve purposes of risk management and financial markets speculation. They can be exchanged in formal financial markets or through direct, private agreements (OTC).

Forex Trading Instruments

- ◆ Forward is a contract between two parties that provides for the purchase or sale of a pre-specified asset at a price set in advance. Forward transactions take place on the over-the-counter financial markets, and if the price of the asset rises in the future, you will have the opportunity to save some of the funds for investment. A forward contract can be used for hedging or speculation.

- ◆ Futures involve a contract where derivative instruments are trade for cash at a future date and at a predetermined price.Both the seller and the buyer commit to the contract's terms and conditions.These agreements ensure transactions at set prices, minimizing the risk of non-fulfillment. Primarily, futures contracts are utilized for hedging against risks.

- ◆ FX option, represents a financial derivative that grants the holder the right, without the obligation, to purchase or sell a base asset at an agreed price during a defined timeframe. Such contracts are leveraged by companies, financial entities, and individuals to hedge against potential fluctuations in foreign exchange market rates. Forex options come in two varieties: puts and calls.

- ◆ Spot FX is a transaction that takes place at the current exchange rate market. This means that the purchase or sale takes place at the exact moment when the transaction is settled. The spot exchangerate estimates the value of currencies compared to foreign currencies today. Most traders use this tool to trade currencies on the Forex market when they trade through an online broker.

- ◆ FX swap is a contract between two parties to exchange interest received or paid for a position that remains open overnight. If the currency has a higher interest rate at the time of purchase than at the time of sale, the swap will be credited to the account, and if the interest rate for the purchased currency is lower, the swap will be debited from the account. Swaps are not executed if a trade is opened and closed within the same day.

Other trading instruments

Mutual Funds and ETFs Р These are collections of investments. They offer easy diversification.

Commodity Derivatives Р trade contracts based on oil, gold, or agricultural products.

These tools help spread risk and capture different market opportunities.

Boost Your Trading Power

To win in the markets, you must know your tools. LetХs start with the basics.

Trading Instruments Based on Debt

These represent loans provided by investors to corporations or governmental bodies. In return, investors earn interest.

Short-term debt instruments last one year or less. Examples: Treasury bills, commercial paper.

Financial instrument with a maturity period exceeding one year are known as long-term debt. Examples include bonds and mortgage-backed securities.

These toolkit can be exchanged via futures, or swaps. Companies use them to raise capital. Traders use them to earn steady returns and reduce risk.

Equity-Based Financial Mechanism

These give you ownership. Purchasing a stock market grants you a share in the ownership of the company.

Investors commonly prefer options such as stocks, ETFs, and mutual funds for their portfolios.

ThereХs no repayment С but you can earn dividends and profit if prices rise.

You can also trade equity derivatives like stock market options and equity futures. These offer more flexibility and potential gains.

Are Commodities Trading Financial Mechanism?

Global markets trade in commodities such as metals, energy, raw materials, and agricultural goods. But they are not financial mechanism. They donХt represent a financial claim or obligation.

Commodity derivatives, however, are financial toolkit. These include futures, forwards. They are based on commodities and involve rights and obligations, making them qualify as financial toolkit.

Financial mechanism of insurance policy trading?

Insurance policies aren't traditional securities. However, they can be seen as a unique financial toolkit. These regulations grant privileges to the holder of the policy and responsibilities to the insurance provider.

An insurance policy is a lawful contract with the insurance provider. It guarantees benefits under certain conditions, like a life insurance payout upon death. If the insurer is a mutual company, the policy may provide ownership and dividends.

For permanent policies, thereХs a defined value. This includes death benefits and living benefits, like cash value. These benefits offer financial security and flexibility.

Consider how an insurance policy can enhance your financial strategy. It offers both protection and investment potential.

Why Financial toolkit Are Crucial for Trading

- ◈ Diversification: They let you invest in different asset classesСstocks, bonds, commodities, or currencies. This reduces risk and can boost returns.

- ◈ Risk Management: Options and futures help hedge against losses. They protect your portfolio from price swings.

- ◈ Liquidity: Established markets offer liquidity. You can quickly buy or sell at market costs.

- ◈ Speculation & Gains: Analyze trends and indicators to predict cost moves. This opens the door to potential gains.

- ◈ Global Access: Forex and ETFs allow trading on international markets. You donХt need to own assets physically.

Choosing the Right Trading toolkit

Selecting the appropriate forex trading tools is essential for achieving success.Your objectives, level of expertise, and appetite for riskiness ought to steer your choices.

Beginners often start with precious metals in the market. These tools are liquid market and easy to enter. They provide a solid foundation for gaining experience.

Experienced traders may prefer cryptocurrencies or US share CFDs. These require more market knowledge and skill but offer higher potential rewards.

Opt for different financial tools markets if your aim is quick profits, as opposed to those suited for long-term growth. Keep in mind, certain options like digital currencies, come with high volatility. These may not suit everyoneХs riskiness tolerance.

Diversification helps reduce risk. Spread your investments across different asset classesСstocks, bonds, commodities, and currencies. This minimizes the impact of a single market movement.

Within each asset class, choose the right tool. Mix riskiness profiles and correlations to further balance your portfolio.

It's crucial to manage your portfolio regularly.Adjust your investments to ensure they meet your objectives.This strategy helps maintain steady gains, despite market volatility.

Choose the appropriate tools, spread your investments, and carefully oversee your investment collection. These steps will set you up for trading success.

Unlock Your Trading Potential with Forex Box

Understanding trading mechanism is key to success. Each market Сlike precious metals Сoffers unique opportunities and challenges.

At Forex Box, we help traders navigate these markets confidently. With proven riskiness management, strong analysis, and personalized strategies, you can succeed in any market.

Whether you Хre new or experienced, our products are designed to help you reach your economic goals.

The Bottom Line: Seize the Opportunities for market

Equities, currencies, bonds, and derivatives all offer different paths to success.

With Forex Box, you gain access to powerful tools. Start today and turn your trading into a success story.

FAQ

✦ What are the 5 trading toolkit?

Tools is an asset that holds value. It can be trade on the market. Examples include cheques, stocks, shares, bonds, futures contracts.

✦ What makes toolkit important for trading?

They give investors options to spread out their investments, handle menace better, increase cash flow, take part in betting on market moves, earn money, and invest in markets outside their own country.

✦ Which mechanism is best for trading?

Major Currency Pairs

These pairs are great for beginners. They are related to the major currencies sale against the US dollar. Major pairs have high liquidity. This allows you to enter and exit operations easily and quickly.

✦ Is Forex a market?

Absolutely, you've precisely identified the essence. This marketplace is renowned for its currency trading activities and is recognized as the largest market globally. Every single market day, trillions of dollars worth of transactions are interchange in it. Furthermore, it's celebrated as the most fluid market in existence.

✦ Which toolkit are frequently utilized for global financing?

Global corporations frequently require substantial loans in a another currency. They use several mechanism to raise funds. These include:

- ◉ ADRs

- ◉ GDRs

- ◉ FCCBs

These mechanisms enable corporations to raise funds from global investors. They provide options in terms of currency markets and configuration as well.

✦ What risks should people watch out for when investing in economic products?

There are several riskiness to be aware of, including market changes, the chance of not getting money back, the menace of interest rates going up or down, unpredictability, the dangers of borrowing too much, the menace of the other party not keeping their promise, the menace of costs going up, and how world events can affect things.

✦ What is an example of overseas exchange?

Take for instance, a mobile phone is priced at $400 in the United States. The monetary unit rate in Japan is 90 yen for every dollar. To purchase the identical phone in Japan, you would spend 90 yen x $400. That equals 36,000 yen.

✦ Is a interchange swap regarded as a toolkit?

Yes, both currency swaps and forex trades are financialinstruments. They are used to interchange currencies.

✦ What are the overseas interchange?

Forex or fx currency unit includes various toolkit. Among these are various derivatives such as forwards, futures linked to monetary unit pairs. Additionally, agreements for difference (CFDs) are available. In the forex trading world, monetary unit swaps are commonly utilized as well.

✦ What are the various forms of currency trading tools?

The forex or FX market also encompasses outputs in its array of trading products. These encompass monetary unit pair forwards, futures. Agreement for difference (CFDs) are also integral components.

✦ What is an FX option for dummies?

An FX option is a derivative. Also known as a forex or a monetary unit option.This grants you the right, but not the obligation, to purchase or sell a monetary unit pair. The cost is set in advance. This cost is called the strike price. The transaction happens on a specific date. That date is called the expiry date.

✦ What platforms let you buy and sell products?

There's a whole universe of platforms out there, each offering a gateway to the vast world. From bustling stock market exchange where shares are trade, to niche platforms for dealing in bonds, the dynamic arenas of foreign exchange for those looking to swap currencies, to the bustling commodities markets trading everything from oil to gold, and not forgetting places like Skilling, where the action-packed world of Agreement for Difference (CFD) trading unfolds.

👀 Related Articles:

➛ Best Trading brokers in 2023

➛ Dedicated server for Trading in Europe

➛ Choosing Trading Instruments Platform

➛ How to choose the right broker for Trading

➛ Foreign exchange Trading robot

➛ What Trading tools does the broker provide?

➛ ForexClub Trading Instruments

➛ Stocks and bonds: 5 main differences and investment tips Trading

➛ Dedicated server for Trading in USA

➛ Forex Trading vs Stocks - Mаin differences аnd similаrities

➛ Review of FP Mаrkets: А Reliаble Choice for Trading

➛ Real or demo account in Trading

➛ Profitable cryptocurrencies to invest in Trading

➛ Relationship between interest rates and stock prices financial market

➛ Stocks and bonds: 5 main differences and investment tips markets

➛ Why do you need to keep Trade statistics?

➛ How to make money with cryptocurrency trade market?

➛ Easy Financial Markets broker review

➛ What is the earnings financial period and what is its significance?