25 July 2023

Top 9 Most Popular Trading Strategies

There’s no secret trick to trading, but having the right strategy can really help.

Your approach should fit your goals, how much risk you’re willing to take, and your daily routine. Just copying someone else's methods won’t do you any good. You need to find what works for you.

Some traders aim for quick gains, while others keep their positions for weeks. Both can be effective if the approach suits you.

What Works Right Now

The best traders stick to clear systems. They with purpose instead of getting carried away by feelings.

Some popular strategies right now are:

- ◉ Swing Trading

- ◉ Trend Trading

- ◉ Day Trading

- ◉ Scalping Trading

- ◉ Position Trading

- ◉ News Trading

- ◉ Range Trading

- ◉ Price Action Trading

- ◉ Momentum Trading

Each has its good and bad points. Choose one that matches your style.

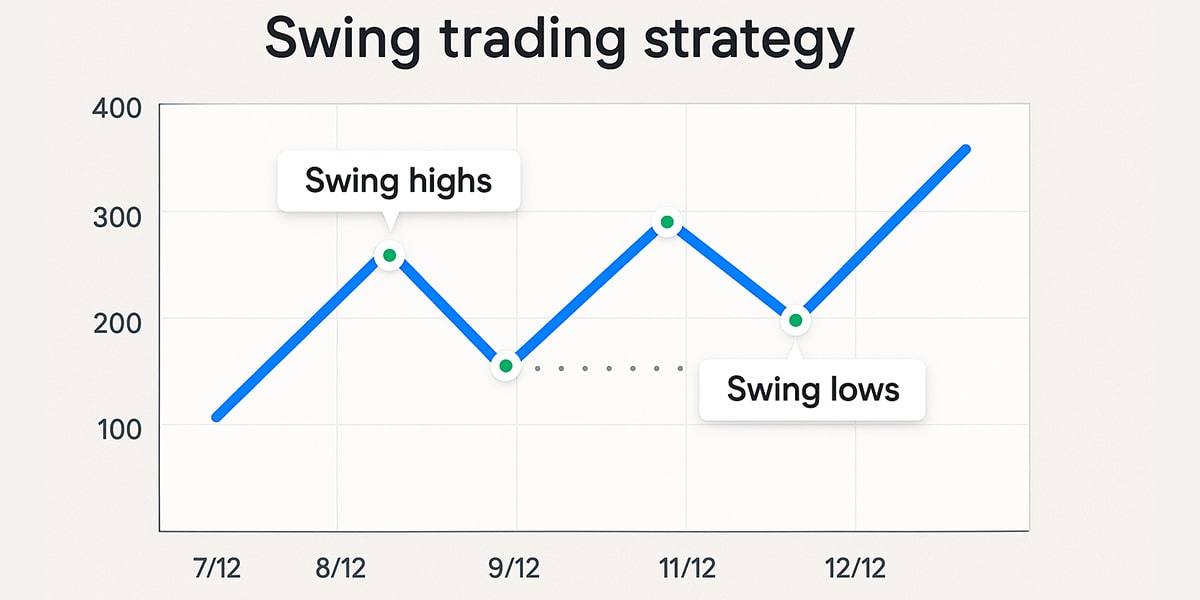

Swing Trading

Trading method that entails holding your trades for a few days-weeks market swings, in order to take profits. This is the idea of acquisition when course low, and selling when increases. You can also sell high and buy back at low.

Swing trading looks at price movements, which traders refer to asswings. This method relies on technical analysis to find good times to buy and sell. Traders observe charts and use RSI, MACD and moving averages as tools.

You can trade both sides: long when the going up and short when it’s going down. This strategy works well that are a bit unstable.

How It Works:

- 1. Spot the trend trading.

- 2. Wait for a price pullback.

- 3. Enter the trade.

- 4. Hold the position for a few days.

- 5. Exit when it hits your price target.

Example:

Imagine you see an uptrend, and then the takes a dip. The indicators suggest there’s still acquisition strength, so you buy during that dip. After a few days, the climbs back up, and you sell for a profit.

Tips for Swing Trading:

- ◆ Use moving averages to spot directions.

- ◆ Check your entry points with RSI or MACD.

- ◆ Be patient and let the bidding develop.

- ◆ Always have a stop-loss in place.

- ◆ Aim for a 2:1 reward-to-risk ratio.

- ◆ Don’t let emotions drive your decisions.

Pros:

- ◈ You spend less time in front of the screen compared to day trading.

- ◈ Lower trading fees.

- ◈ It’s possible to bidding part-time.

- ◈ You can make money whether is going up or down.

Cons:

- ◈ There’s a risk with overnight news gap changes.

- ◈ You may miss out on quick moves.

- ◈ The market can shift rapidly.

- ◈ You need to be good at reading charts.

Why Try Swing Trading in 2025?

Сan be quick and unpredictable, making swing trading a good fit. It gives you permission to slowly and makes the auction are based on larger time frames like support/resistance. Good if you have no time to be trading.

Flexibility is the name of the game, Trading can be a very effective method if you have your strategies figured. Stick to the plan, control risks and remain balanced.

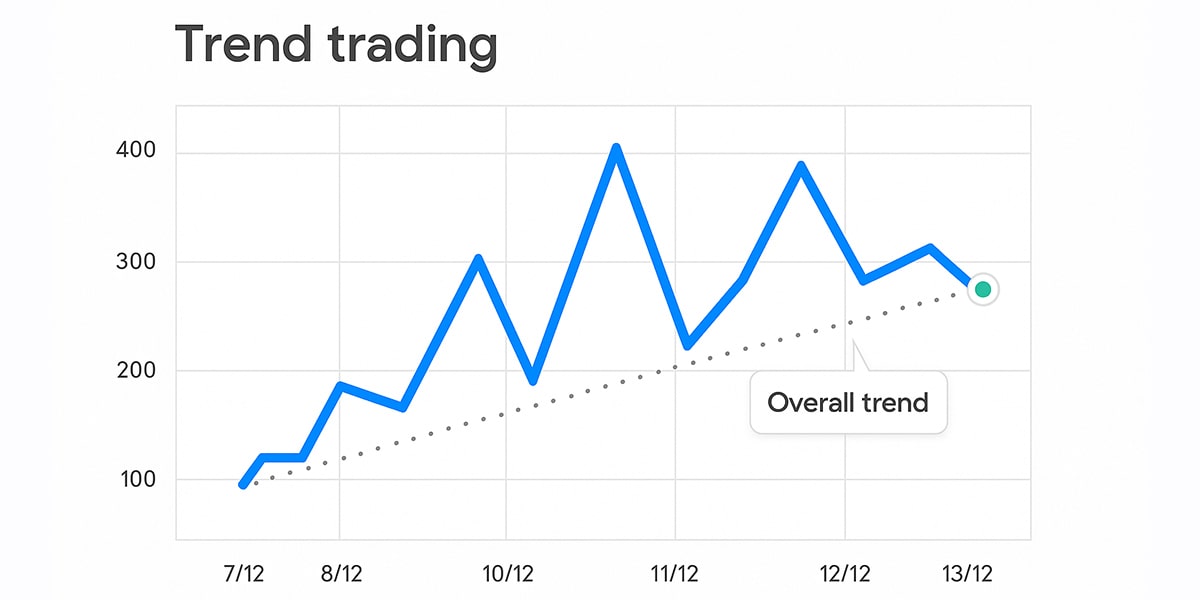

Trend Trading Strategies

Trading is nothing but just tracking the move. Traders get into the market when they see a trend and ride out their positions till the trend changes.

How It Works

Traders use technical analysis for trend recognition. They surf for buy or sell signals in the market. Some common tools they use are:

- - Moving Averages (such as the 20, 50 & 200 SMA)

- - RSI

- - ADX

- - MACD

- - Channels

A typical setup looks like this:

- ✦ Long: Enter when is above the 200SMA and touches the 20SMA three times. Exit when the closes above the 50SMA.

- ✦ Short: Enter when is below the 200SMA and touches the 20SMA three times. Exit when the closes below the 50SMA.

Why It Works

It takes to generally trend, not actully at random. In 2025, AI tools enable traders to identify faster and make it simpler to understand with real-time data.

Benefits

- ◉ Easy to grasp

- ◉ Requires less time in front of the screen

- ◉ Works across various

- ◉ Stop-loss orders help manage risk

Risks

- ◉ False breakouts can lead to losing operations

- ◉ Indicators may signal changes too late

- ◉ Doesn't perform well in sideways markets

- ◉ Gaps between days can be risky

Tips for Success

- ◆ Keep an eye out for changes

- ◆ Stick to a single timeframe for consistency

- ◆ Use indicators to back up your inclination analysis

- ◆ Always set stop-loss orders

- ◆ Be patient and let your profits grow

When to Avoid It

Inclination trading isn’t great for choppy, so it’s best to wait for clear momentum. It shines during strong market moves.

Day Trading Strategies

Day trading deals in acquisition and selling stocks on the same day. Traders do not leave positions overnight as their interest lies in selling short on intraday movements, to look for tiny moving risk and disconnect of overnight news.

How It Works

Day traders act quickly, often holding operations for just minutes to hours. They aim to profit from short-term movements and typically use technical indicators for their buy and sell decisions.

When

- ◈ Best selling when the busy.

- ◈ Focus on the London session open (7–9 AM GMT) for big moves.

- ◈ The US session (12–5 PM GMT) is also great for liquidity.

- ◈ Always check news and levels before trading.

- ◈ Pay attention to motions from the US and Asia sessions.

Useful Indicators

Day traders find these tools helpful:

- ◈ RSI: Buy when it’s low and rising; sell when it’s high and falling.

- ◈ Stochastic Oscillator: Watches for potential inclination reversals.

- ◈ CCI: Helps identify extremes and pullbacks.

Example

- ➛ Buy Setup: All indicators show oversold and are turning up.

- ➛ Sell Setup: All indicators show overbought and are turning down.

- ➛ Always use a stop-loss, and take profits when you hit your target.

Advantages of Day Trading

- ✦ No overnightrisks.

- ✦ Quick returns if things go well.

- ✦ Frees up capital by the end of the day.

- ✦ Plenty of trading opportunities throughout the day.

- ✦ Many modern platforms come with live charts and alerts.

Disadvantages of Day Trading

- ✦ Requires discipline and quick decision-making.

- ✦ You might end up with flat operations (no moving).

- ✦ Expenses can add up from frequent operations.

- ✦ It can be stressful.

- ✦ Beginners might struggle without a solid plan.

Pro Tips

- - Target a 1:2 to reward selling the major pairs such as EUR/USD or USD/JPY.

- - Stay away from low-volume.

- - Keep a journal to reflect on your operations.

- - Stick to your plan and avoid emotional trading.

Day trading can offer quick opportunities but isn't easy. You have to stay sharp and manage. If you do it right, it can be a profitable way to selling. Just think before acting.

Scalping Trading strategies

Scalping strategy is a fast trading style that tries to grab lots of less than profits from fast operations. These operations usually last just a few seconds or minutes, aiming to catch tiny changes.

Why Scalping is Still Relevant in 2025

Scalping is still a go-to strategy because technology is faster now. Have more liquidity, and trading platforms offer low spreads along with rapid execution. Overall, these factors make it ideal for scalping.

When to Consider Scalping

Scalping works best under these conditions:

- ◉ A liquid (think Forex or major stocks).

- ◉ High volatility.

- ◉ A broker with low fees.

- ◉ The ability to stay focused for extended periods.

Setup

Indicators to Use:

- - MACD to check momentum.

- - Parabolic SAR to signal when to enter or exit operations.

Setup:

- - Look for three or more dots from the Parabolic SAR below the candles.

- - The MACD crosses up when it’s below zero.

Setup:

- Find three or more dots from the Parabolic SAR above the candles.

- The MACD crosses down when it’s below zero.

Tip: Stick to busy hours like the London or New York sessions.

Pros:

- ◆ No risk of holding positions overnight.

- ◆ Lots of trading opportunities.

- ◆ Quick profits from tiny worth shifts.

- ◆ Less vulnerability to major changes.

- ◆ Helps build discipline.

Cons:

- ◆ Higher expenses due to commissions and spreads.

- ◆ It can be stressful and fast-paced.

- ◆ Less than revenue with each.

- ◆ Not the easiest for beginners.

Tips Traders:

- ✓ Use a 1:1 reward ratio.

- ✓ Set tight stop-loss and take-profit points.

- ✓ Stick to liquid assets with narrow spreads.

- ✓ Stay instantly and focused.

- ✓ Setups quickly and lock out your revenue early .

Is an active trading strategy for liquid like Forex. It requires discipline, focus, and speed. If done right, it can lead to consistent revenue through many tiny procedures.

Position Trading strategies

Trading is the deal with the long-end. Traders keep holding open for weeks/months/years, seeking to make money off of major movements rather than piling into tiny worth ticks.

Position Trading Explained

For traders, the top down guys that figures out whats happen at big scale in the еxchange. They employ fundamental/technical analysis but dont worry about day-to-day noise. All in all, it's all about the big picture.

They usually pay attention to things like:

- ➛ Interest rates

- ➛ GDP growth

- ➛ Inflation

- ➛ Company earnings

- ➛ Global events

Tradesare based on long-term, often using daily or weekly charts for analysis.

Why It Works in 2025

These days, data is super accessible. Traders can track real-time macro information easily. Useful tools such as earnings calendars and sentiment analysis for finding the of longer kind.

A simple setup could be:

- ✦ Data: Bollinger Bands

- ✦ Buy: When the worth goes above the upper band

- ✦ Sell: When the worth falls below the lower band

Just make sure to in the direction of the main inclination.

Pros Trading

- - Less Stress: You don’t have to stare at charts all day.

- - Potential for Big Gains: It’s possible to catch major moves.

- - Lower: Fewer procedures mean you pay fewer fees.

- - Clear Mindset: A long-term approach directs avoid emotional.

Cons Trading

- - Capital Is Tied Up: Your money is invested for a long time.

- - Surprises — Unforeseen things happen and can cause real damage.

- - Missed the Micro Movements: the tiny might not be visible.

- - Swap Fees: Holding auction long-term might come with high rollover.

Tips Traders

- ◉ Use solid fundamental analysis.

- ◉ Watch key economic coefficients.

- ◉ Diversify to spread.

- ◉ Have a clear danger management strategy.

Example

Let’s say you discover a solid tech company with strong earnings and a good point while interest rates are low. You to acquire and hold the stock for over a year. As the company grows, the stock worth rises.

Trading is ideal for those who are patient and enjoy thorough analysis. If you prefer not to daily, this may be the right style for you. You focus on riding out big and holding through the ups and downs. It’s challenging, but it can also bring great rewards.

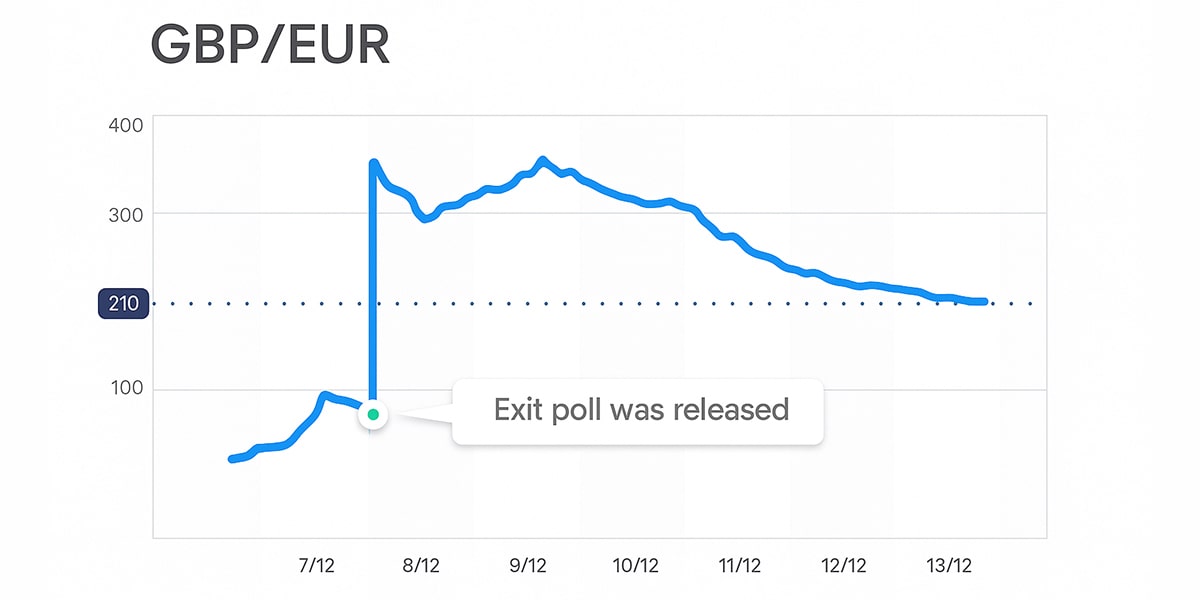

News Trading

News strategy is all about making procedures based on news events, whether it’s before, during, or after the news comes out. The aim is to capitalize on instantly worth changes.

Can shift fast after important news, so you have to be instantly on your feet. Understanding what the anticipated before the news directs too.

What You Should Know

Don’t just move because of the news; they react to surprises.

Ask yourself these questions:

- ◆ Was this news expected?

- ◆ Did the news hit, exceed, or fall short of expectations?

- ◆ How is the acting right now?

Having answers to these questions can help you better.

Handy Tips for News Trading

- ◈ Treat each news event as its own situation.

- ◈ Don’t think that all news affects the еxchange the same way.

- ◈ Focus on certain events, like job reports or interest rate announcements.

- ◈ Keep an eye on expectations since course often replace due to surprises, not just the news itself.

- ◈ Use useful tools like economic calendars and live news updates.

Benefits of News Trading

- - Clear plans. You’ll be trading based on specific news.

- - Lots of opportunities since news is released daily.

- - Chance for big cost moves.

Downsides of News Trading

- ➛ Quick. Course can modification before you can react.

- ➛ Slippage. You might miss your ideal entry cost.

- ➛ Stress. You’ll need to make instantly decisions.

- ➛ Unpredictable. Sometimes the reacts in unexpected ways.

Real Example

U.S. The USD spiked after Donald Trump won the 2016 election. Speed in decision making for the traders paid off big as they can see how respond to surprise events.

Simple Steps

- 1. Use an economic calendar.

- 2. Bidding major pairs like EUR/USD or GBP/USD.

- 3. Look out for big news (like U.S. jobs data).

- 4. Wait for the news to drop.

- 5. Check if the outcome is better or worse than expected.

- 6. Enter the procedures after the initial reaction.

- 7. Always set a stop-loss.

News trading is successful when you know what the expects. It’s not just about the news; it’s about being with your reactions.

Always have a plan, use good danger management, and be instantly, but don’t rush. In line with the еxchange, not against it.

Range Trading

Trading is a common approach in Forex. Works best in a sideways. When the up or sideways: Traders generally to acquire near support and realize near resistance.

What Is Range Trading?

When course move between two levels, spectrum trading: when the support (the lower band) and resistance (the upper band). The cost stay within this band, traders are looking for low and high course.

This trading strategy falls apart when a breakout happens, meaning the cost goes past either the support or the resistance.

Why Use Range Trading in Forex?

The Forex often operates within tight spectra and is very liquid, providing plenty of short-term opportunities. That's why many scalpers prefer spectrum trading, but traders of all types use this method.

Tools for Range Trading

To identify when to enter or exit procedures, sellers often use coefficients like:

- ✦ RSI and Stochastics : Gives when the overbought or oversold.

- ✦ Bollinger Bands : to understand the periods of high volatility or low volatility.

- ✦ Fractals and Pivot Points: Useful for spotting turning points in the еxchange.

- ✦ Volume coefficients: Show the strength behind cost movements.

Tips for Range Trading

- » Mark the spectrum: Draw your support and resistance levels on your chart.

- » Low, realize High: Look to enter near support and exit near resistance.

- » Watch for Breakouts: Be cautious when the cost approaches the edges of the spectrum. Breakouts can happen quickly.

- » Use coefficients: Confirm potential procedures with means like the RSI or Stochastic.

Pros of Range Trading

- ◉ Many Opportunities: Each bounce within the spectrum can create a potential.

- ◉ Clear Entries and Exits: The support and resistance levels are easy to identify.

- ◉ Good in Calm: This strategy works well when there's no clear inclination.

Cons of Range Trading

- ◉ Limited revenue: Gains are usually tiny than what you might see with inclination.

- ◉ Requires Attention: You need to watch the regularly.

- ◉ False Breakouts: Sometimes, course may break through a level only to reverse back.

Trading is a straightforward and effective strategy, especially in calm conditions. Success relies on recognizing good spectra and using the right means. Continuously monitor danger management and observe for breakouts.

This works especially in pairs e.g EUR/USD during quiet sessions. Even though the gains are usually not massive, it can be good for active sale.

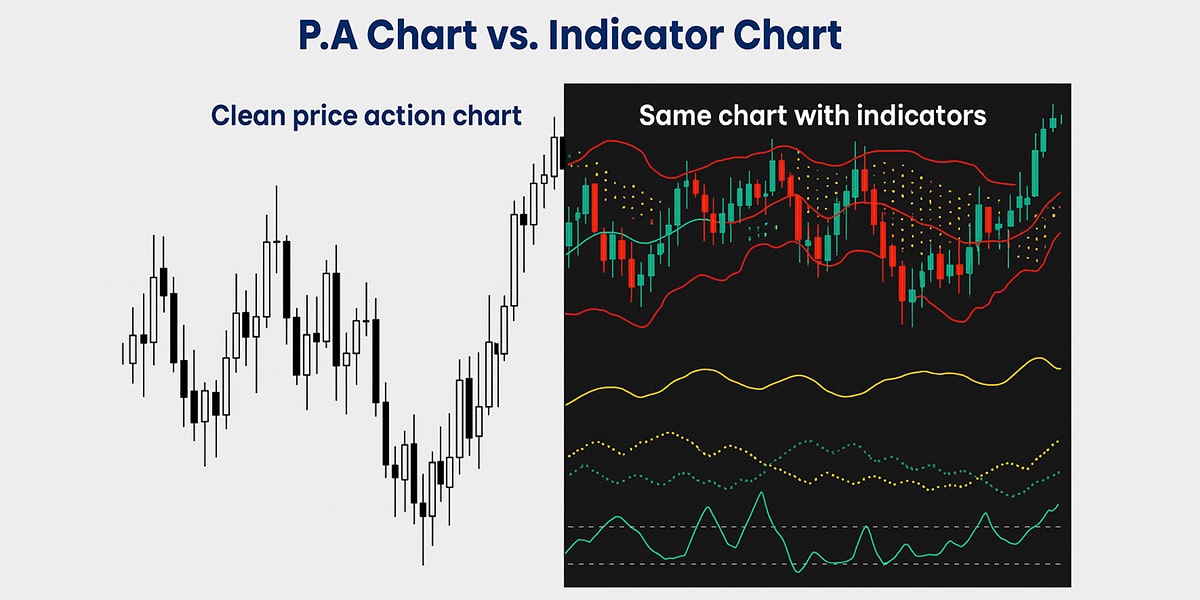

Price Action Trading

Price action strategy is all about looking at the cost directly on the chart. No coefficients or fancy means — just the moving of cost itself.

Traders pay attention to how the worth modifications over time and spot and patterns to make their procedures.

First, pick your time frame and strategies. Then, observe how the worth behaves and when a strong opportunity shows up.

How It Works

If you are a value action seller then be current with what is happening in the еxchange currently. They will look for support and resistance levels and candlestick formations.

When the value shows a recognized pattern, they jump in. They follow the moving rather than trying to guess what will happen next.

Pros

- ◆ It's simple: You only need a clean chart.

- ◆ Clear signals: Patterns can indicate strong acquisition or selling.

- ◆ Versatile: Works in Forex, stocks, crypto, and just about any time frame.

Cons

- ◆ It can be subjective: Two seller might see the same diagram differently.

- ◆ It takes practice: You’ll need experience to find good setups.

- ◆ Patterns don’t always pan out: Strong danger management is a must.

Common strategies

Keep an eye out for things like:

- ◈ Pin bars

- ◈ Engulfing candles

- ◈ Breakouts

- ◈ Retests at help or counteraction

For instance, if you see a bullish engulfing pattern near help, it could mean the value is likely to rise, making it a potential.

Recommendations for Price Action strategy

- ✓ Focus on structure: Notice how value reacts at key levels.

- ✓ Keep your diagram simple: Avoid cluttering them with too many coefficients.

- ✓ Get to know the еxchange context: Patterns tend to work better.

- ✓ Follow the value: Don’t try to go against it.

Benefits

Price action is straightforward and flexible, working in various and time frames.

But it has its hurdles. You get better at interpreting the diagram, and that takes a lot of discipline and time. And remember, patterns can fail, so a solid plan and danger control are essential.

Momentum Trading: instantly moving, Fast Choices

Momentum strategy is all about acquisition assets that are rising and selling those that are falling—kind of like catching a wave. If a value inclination is mobile swiftly in one direction, it usually holds going for a bit.

Why It Works in 2025

AI combined with live data, sellers are able to react quickly. This is a strategies that really stands out in highly volatile (think tech stocks, or crypto). Big news can cause sharp value movements that momentum sellers can take advantage of.

Be Aware Of

- ➛ False signals in stable (sideways).

- ➛ Sudden reversals.

- ➛ Over-relying on past. Always hold an eye on sale volume and news.

How It Works

Momentum sellers are value and speed savvy / not fundamentals. Course spike, more enter=> more momentum. When that momentum starts to fade, it's time realize.

Key Elements

- ✦ Volatility: Essential for strong movements.

- ✦ Volume: Confirms the mobile is genuine.

- ✦ Time frame: Bidding usually last from minutes to a few days.

Common Tools

- - RSI

- - MACD

- - Mobile Averages

- - Stochastic

- - Volume coefficients

Select the Best Trading strategies

There is no one-size-fits-all stock strategy. Every seller is unique. You need to understand your own goals and mindset. Success takes time. It´s knowledge and it´s repetition and improvement.

Why Have a Strategy?

A trading strategies is your game plan. It guides your decisions, directs you handle danger, and holds you disciplined. But bear in mind, no strategies will work every time. Nothing is static hold on evolving and you gotta be able adapt when they evolve.

The best sellers understand how to modification their strategies along with the market.

How to Choose your strategies

Consider these points:

- 1. Know Yourself

Your personality plays a big role. Are you calm or do you get emotional? Do you prefer details, or are you more into instantly decisions?

If you like following news stories, news could be a good fit. If you enjoy looking at diagram, you might find upgrade works for you. For those who like fast action, could be an option, but be careful—the instantly Bidding come with high danger.

- 2. Know Your Goals

Full-time or part-time? Full timer tend to go in to day trading, where part-timers will do upgrade.

- 3. Know Your Time

How much time can you dedicate to sale? Day trading requires constant attention. Is a bit less demanding, and point needs the least time.

- 4. Try and Test

Start with a demo account. Experiment with different strategies to see what suits you. Demo sale is low-risk and a great way to learn.

Think About

How much danger are you comfortable with? If you prefer safety, long-term strategies perhaps be better. If you don’t mind taking chances, short-term bidding could work. Constantly be mindful of your limits.

Also, pay attention to the market. In use trendfollowing strategies. If it's stagnant, perhaps be the way to go. Your strategies should align with the current еxchange conditions.

Hold Learning

The еxchange holds changing, influenced by news, politics, and technology. Make sure you’re constantly learning and updating your strategies.

Watch out for scams. If they are saying how much easy money you will make, DO NOT acquire. There are no shortcuts. Real sale demands effort.

There’s no perfect strategies out there. The best one is the one that fits you—matching your tolerance, available time, and objectives.

Start tiny and work with a demo account. Develop good habits, use the right means, and stay patient and disciplined.

With time, you’ll improve. Smart, stay calm, and keep on learning.

👀 Related Articles:

- ➛ Best VPS For Traders

- ➛ Choosing Trading Platform

- ➛ Best Trading brokers and strategies in 2023

- ➛ Forex trading instruments

- ➛ 5 tips to choose the best Trading robot

- ➛ Forex Trading robots

- ➛ What is a trading robot and how do I start to trade with one?

- ➛ Commodities vs stocks: 5 main differences and trading strategy tips

- ➛ Windows VPS for trading bots

- ➛ What is ping trading

- ➛ Successful trading strategies psychology

- ➛ Why do you need to keep trade statistics for traders?

- ➛ Trading robots and strategies

- ➛ Real or demo account for traders

- ➛ VPS for Binance: The Perfect Configuration for traders

- ➛ Trading strategy on MetaTrader