9 September 2025

What is MetaTrader 4 and why does a trader need it?

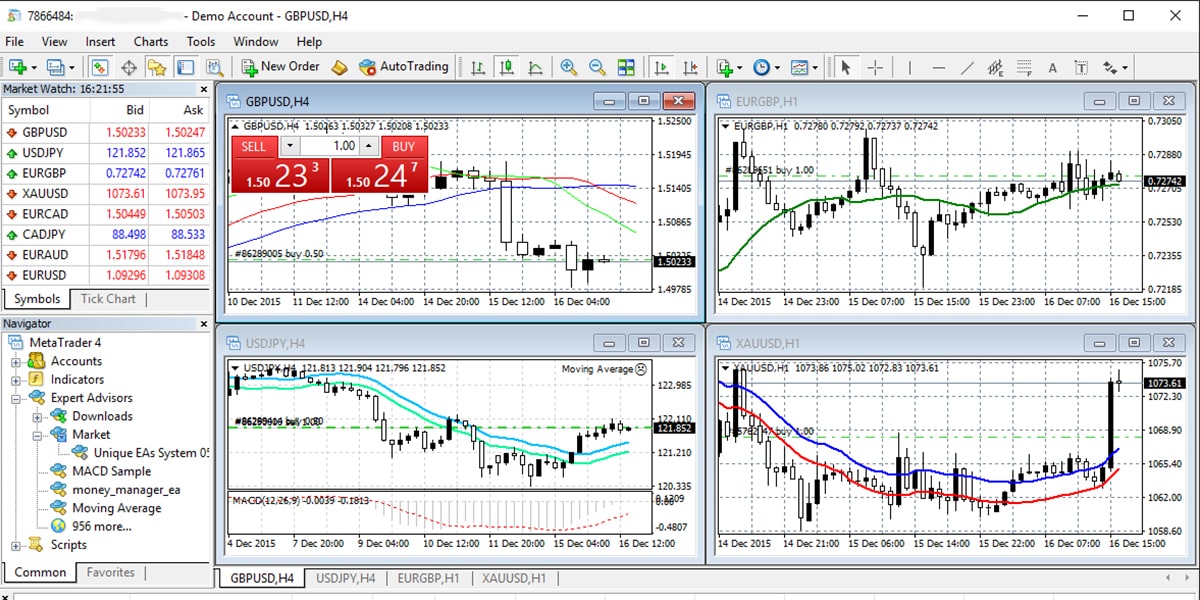

MetaTrader 4 (MT4) is the most popular Forex trading platform, with which 9 out of 10 traders start.͏

The terminal was made by MetaQuotes in 2005 and is still the industry standard. People choose it for its simple interface, availability on different devices, and flexibility — from manual trading to algorithms and copy trading. MT4 works on Windows, Mac, Android and iOS. Even if the broker has its own platform, MT4 is almost always supported.

Key Features of MT4

MT4 has everything a trader needs: assets, charts, indicators, orders, and stops.

- ◉ Trading assets: currency, gold, oil, CFDs on indices and stocks — the set depends on the broker.

- ◉ Timeframes: from M1 to MN1, convenient for scalping and midrange.

- ◉ Charts: Japanese candlesticks, bars, line — the base for analysis.

- ◉ Indicators: built-in + the ability to set custom ones. Moving averages, MACD, RSI, Fibonacci — everything is at hand.

- ◉ Graphic objects: trend lines, levels, channels.

- ◉ Pending orders: buy/sell stop, buy/sell limit.

- ◉ Stop loss and take profit: mandatory risk management tools.

- ◉ Trailing stop: automatic pull-up of the stop following the price is convenient for trend trading.

How to get started with MetaTrader 4

It's simple: account → deposit → installation → login → chart → transaction.

- ◆ Step 1. Open a trading account. It's better to start with a demo in order to get your hands on it without risk. Then switch to the real one.

- ◆ Step 2. Deposit. The minimum amount depends on the broker. Don't deposit a large amount right away — start with $100-300 for practice.

- ◆ Step 3. Install MT4. On Windows it is installed in a couple of clicks, on Mac sometimes emulation is needed. There are mobile versions.

- ◆ Step 4. Log in to your account. Use the login / password from the broker.

- ◆ Step 5. Set up a schedule. Select an asset, add indicators, and save the template.

- ◆ Step 6. Open a deal. The "New Order" button or double-click on the instrument.

- ◆ Step 7. Install SL and TP. Don't trade without a stop — the market is always stronger.

- ◆ Step 8. Close the deal. Either manually or by stop/take.

MT4 Tools and Advanced Features

MT4 is not just a buy/sell button, but an entire ecosystem.

- ◈ EA Expert Advisors: algorithmic trading on MQL4. You can write your own or buy ready-made ones.

- ◈ Trading signals: subscription to copy trades of successful traders.

- ◈ MetaTrader Market: a store of indicators, robots, and utilities.

- ◈ Alerts and news: help you keep track of events and signals.

Testing strategies in MT4

Any strategy is tested in a tester, not on a live account.

The built-in Strategy Tester allows you to run Expert Advisors based on history. There you can optimize parameters, test ideas, and see how the strategy has behaved in the past. The negative tester only works with Expert Advisors, manual strategies are checked manually.

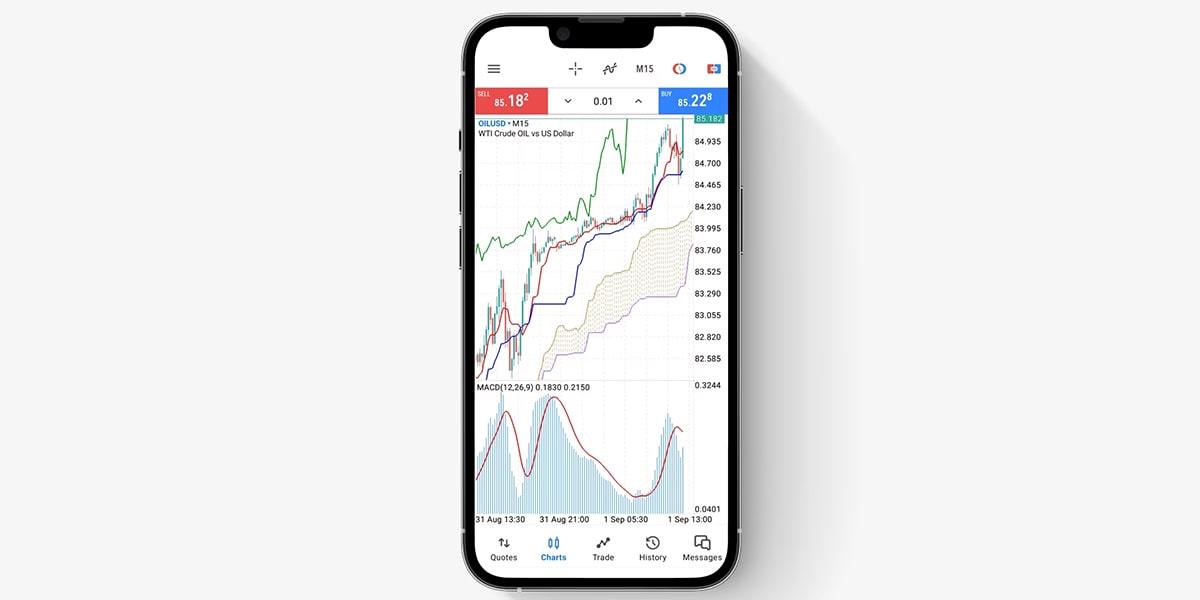

Mobile trading in MT4

The MT4 app is a rescue when you are not at your computer.

Almost full functionality is available on iOS and Android: charts, indicators, trades, stops. But there are limitations — it is inconvenient to build complex analytics, and there are few testing tools. Therefore, mobile MT4 is more about position control and quick trades, rather than deep analysis.

Advantages and disadvantages of MetaTrader 4

MT4 is simple and reliable, but there are limitations compared to MT5.

Positive:

- ✦ a time-tested terminal;

- ✦ minimum PC requirements;

- ✦ broker support worldwide;

- ✦ flexibility: indicators, robots, signals.

Minuses:

- ✦ limited order types (there are more in MT5);

- ✦ outdated interface;

- ✦ limited strategy tester;

- ✦ There are some modern functions missing (for example, a glass).

Secrets and tips for working with MT4

- » Work faster and more conveniently by using hidden functions.

- » Keyboard shortcuts: F9 — new order, Ctrl+M — list of tools, Ctrl+N — navigator.

- » Templates: Save a set of indicators and chart style so that you don't have to adjust it every time.

- » Terminal optimization: clean the quotation history and unnecessary indicators — the terminal will start working faster.

Alternatives to MetaTrader 4

Besides MT4, there are MT5 and online platforms.

MetaTrader 5: more modern, with extended orders, a glass and an advanced tester. But some traders remain on MT4 due to habit and the huge number of ready-made Expert Advisors.

LiteFinance and other online platforms: convenient if you don't want to install software. But they have less flexibility for customization.

Additionally:

- ◉ MT4 and psychology. The terminal is just a tool. The biggest mistake of beginners is to think that it is the platform that "earns". In fact, discipline and risk management decide everything.

- ◉ Working with the demo. Many people stay too long on a demo account. After a couple of weeks of practice, I recommend switching to real money from at least $100. Even small amounts of money involve real emotions and teach you control.

- ◉ Expert Advisors and automation. Robots are not the "grail". It is better to use them as assistants: automatic foot lift, partial position closure, signals. The decisions are still up to the trader.

- ◉ Alerts and levels. To avoid sitting at the monitor for days on end, set alerts. Let MT4 inform you when the price is approaching your zones. It's disciplining and saves time.

- ◉ Maintaining statistics. Download MT4 reports and analyze trades. Every trader has strengths and weaknesses, and only statistics show this honestly.

- ◉ Mobile MT4. It is good for controlling positions and quick actions, but full-fledged analysis is always more convenient on a PC.

Personal experience: how I use MT4 in trading

I use MT4 daily to analyze, find entry points, and control trades.

For me, MT4 is not just a terminal, but a workplace. In the morning, I open several charts — usually EURUSD, GBPUSD, gold and oil. I immediately calculate the key levels, build trend lines and check the indicators: EMA, RSI and volume.

When I see an interesting situation, I open a deal, always with a tight stop loss. In MT4, I have set up templates: one for scalping, the other for midrange. It saves a lot of time.

To test strategies, I periodically run Expert Advisors through the Strategy Tester, but I conduct real trading with my hands — robots work only as assistants for me.

On the road, MT4 on your phone is a way to monitor positions and close a deal if necessary. But basic analytics is always from a computer — it's more reliable this way.

My advice to beginners is: don't chase after hundreds of indicators and Expert Advisors. Master the basic MT4 tools, learn how to work with levels, stops, and risk management. Everything else will come with experience.

MT4 checklist for beginners in 1 day

In one day, you can master the base and start practicing.

- ◆ Download MT4 from a broker (it's better to start with a demo).

- ◆ Install the terminal on your computer or phone.

- ◆ Log in to your account — the demo account will give you access without risk.

- ◆ Open the EURUSD chart — a classic pair for practice.

- ◆ Set the indicators: EMA 50/200 and RSI — no more.

- ◆ Draw the support/resistance levels.

- ◆ Open a deal with a minimum lot and immediately set a stop loss.

- ◆ Close a deal manually — feel the mechanics.

- ◆ Save the chart template so that you don't have to set everything up all over again.

- ◆ Repeat on different timeframes — from M15 to H4.

After a day of such practice, a beginner is no longer afraid of the interface and understands how to open/close trades, place stops and analyze the market. Everything else comes with experience.

MT4 for the pros: what you should definitely use

When I've mastered the base, it's time to unlock the hidden potential of MT4.

- ◈ EA Advisors. Even if you trade with your hands, you can connect a semi—automatic machine - for example, a robot that pulls up a stop loss itself or partially closes a deal. It saves nerves.

- ◈ Strategists are a tester. Test your ideas on history before you go to the real world. Serious traders don't test at random — MT4 provides all the tools.

- ◈ Alerts by levels. Adjust the signals to the key zones so that the terminal "calls" you to the schedule only at the right moment.

- ◈ MetaTrader Market. The store has paid and free indicators, utilities, and robots. The main thing is to filter the garbage and choose what really helps.

- ◈ Custom indicators. Write or order your own on MQL4. This gives you a huge advantage over the crowd that sits on the standard RSI.

- ◈ Multiaccount terminals. If you work with multiple brokers or strategies, you can use MT4 to manage everything from one window.

- ◈ Transaction log and reports. MT4 allows you to upload statistics, and pros always analyze where the strengths and weaknesses of their trade are.

For a beginner, MT4 is a tutorial. For the pros, it is a flexible constructor from which you can assemble a full—fledged trading system.

My Personal MT4 Life Hacks

The simpler the approach, the more stable the trade.

- ➛ Indicators: I always keep only 2-3 basic ones — EMA (50 and 200), RSI (14) and volume. I clean the rest so as not to clog the screen.

- ➛ Templates: I made 3 working templates — for scalping (M1–M15), for intraday (H1), for midday (H4–D1). Switching takes seconds.

- ➛ Keyboard shortcuts:

F9 — quickly open a new order;

Ctrl+T — a terminal with transactions;

Ctrl+M — list of tools;

Ctrl+N — navigator (with indicators and Expert Advisors).

- ➛ Alerts: I set the key levels so that the terminal signals when the price approaches the zone of interest. This way you don't have to "stare" at the chart all the time.

- ➛ Transaction history: I regularly upload and analyze where I made a mistake. MT4 allows this, and such reports are very disciplined.

- ➛ Trailing stop: I turn it on only on strong trends, so as not to be cut off by random noise.

These small chips allow you to keep the terminal "clean" and trade as disciplined as possible.

Conclusion

MT4 is a trader's workhorse.

It is older than MT5, but still remains the main terminal in the market. For a beginner, it is the best choice to master trading. For the pros, it's a convenient environment with indicators, robots, and copy trading. If you want stability and flexibility, MT4 will give you everything you need. But if you need modern functionality and an advanced strategy tester, take a closer look at MT5.

Bottom line: MetaTrader 4 is a tool that has survived generations of traders and remains relevant. The main thing is not the platform itself, but how you use it: discipline, strategy, and risk management.

FAQ

- ✦ The MQL4 and MQL5 languages: differences

MQL4 is simpler, MQL5 is more powerful and closer to C++.

- ✦ MT4 and MT5 — what should I choose?

MT4 is simpler and more familiar, MT5 is more modern. Beginners should start with MT4.

- ✦ Is it possible to use MT4 without a broker?

No, you need a broker, otherwise transactions are impossible.

- ✦ Is MT4 suitable for beginners?

Yes, this is the most convenient platform to start.

- ✦ Is it possible to use MT4 without internet?

No, MT4 only works with a constant connection to the broker's server. Without the Internet, transactions will not open and schedules will not be updated.

- ✦ Does MT4 support hedging?

Yes, in most brokers MT4 allows you to open multidirectional trades on one instrument (buy and sell at the same time). But some companies with an American license do not allow this.

- ✦ Do I need a VPS for MT4?

A VPS is not required for manual trading. But if you use Expert Advisors, money trading, or want round—the-clock stability, VPS is extremely useful.

- ✦ Is it possible to trade cryptocurrencies on MT4?

Yes, if your broker provides CFDs on cryptocurrencies. It all depends on the available tools from a particular broker.

- ✦ What is the minimum deposit required for MT4?

It depends on the broker. Formally, you can start with $10, but it is more comfortable to trade at least from $100-200 with a risk of no more than 1-2% per trade.

- ✦ Which trading style is better for MT4?

The platform is suitable for both scalping and mid-range trading. But for beginners, I recommend starting with intraday or swing trading - it's quieter and there are fewer mistakes.

- ✦ Should I upgrade to MT5?

If you have already set up Expert Advisors and indicators for MT4, you can stay. If you need advanced features (an economic calendar, more timeframes, a glass of prices), you should try MT5.

- ✦ Is it possible to study on demo and earn money right away?

You can't earn money on a demo account, you only need it for practice. Real experience and discipline appear only on live transactions, even with a small deposit.

- ✦ What mistakes do newbies make most often in MT4?

The main mistakes:

- - trading without stop loss;

- - The lot size is too large;

- - using dozens of indicators at the same time;

- - trading "at random" without a strategy;

- - opening deals on the news without understanding the risk.

- How to avoid these mistakes?

- - Always set a stop loss;

- - risk no more than 1-2% of the deposit per transaction;

- - use a maximum of 2-3 indicators in the system.;

- - test your strategy on the history before trading;

- - on the news, either exit the market or place protective orders in advance.

- ✦ Is it possible to make money in MT4 by copying other traders?

Yes, but you have to be careful. It is better to choose traders who have been trading for a long time, rather than those who have earned in a month.

- ✦ How can I tell if an MT4 strategy is working?

It should show stable results on at least 100-200 trades in the strategy tester and demo. If there is profit only in certain periods, the strategy is weak.

- ✦ What is more important in MT4: indicators or discipline?

Discipline. Even a simple strategy with Moving Average and RSI will bring results with proper risk management. And without discipline, you can merge a deposit with any indicators.

- ✦ How to choose the right Expert Advisor (robot) for MT4?

Don't chase the "grail" with the promise of 1000% per month. A good ADVISOR shows stable, albeit small, profits. Be sure to test it on the history and on the demo account.

- ✦ Can I trust free Expert Advisors?

Most often, free Expert Advisors are "sharpened" by past data and merged in real trading. There are exceptions, but they are few. It is better to understand the MQL4 yourself and refine it for yourself.

- ✦ How to test an Expert Advisor in MT4?

Use the Strategi Tester. Run the robot through the history for at least 3-5 years and look at the drawdown. If the maximum drawdown is above 30-40%, it is risky.

- ✦ Do I need a VPS for car trading?

Yes, without a VPS, the ADVISOR can stop when the computer is turned off or there are problems with the Internet. The VPS provides round-the-clock MT4 operation.

- ✦ Is it worth launching multiple Expert Advisors at the same time?

It is possible, but only if they do not logically conflict. For example, one works on EUR/USD, the other on gold. The main thing is to keep an eye on the total drawdown and risk on the account.

- ✦ How do I understand that the ADVISER drains the deposit?

If the robot opens too many orders without stop losses, averages positions and quickly increases drawdown, this is a bad signal. In such cases, it is better to stop working and review the settings.