12 September 2025

What is a lot on Forex and how to calculate it

A lot is the standard volume of a Forex transaction. One standard lot is 100,000 units of the base currency.

In trading, everything is measured not by the number of "pieces" purchased, but by lots. This simplifies the calculation and standardizes trading. In order for a beginner not to lose a deposit, it is important to understand that the lot directly affects the amount of profit and loss.

͏

What is a lot in trading?

Lot is a unit of measurement for the transaction volume.

If you open a deal with 1 lot in EUR/USD, it means that you are buying or selling 100,000 euros against the dollar. At 0.1 lots — 10 thousand euros, at 0.01 — one thousand euros.

The difference from other markets:

- ◉ In the stock market, a lot is a fixed number of shares (usually 100).

- ◉ In Forex, it is a universal measure of volume that varies in (standard, mini, micro, nano).

Types of lots

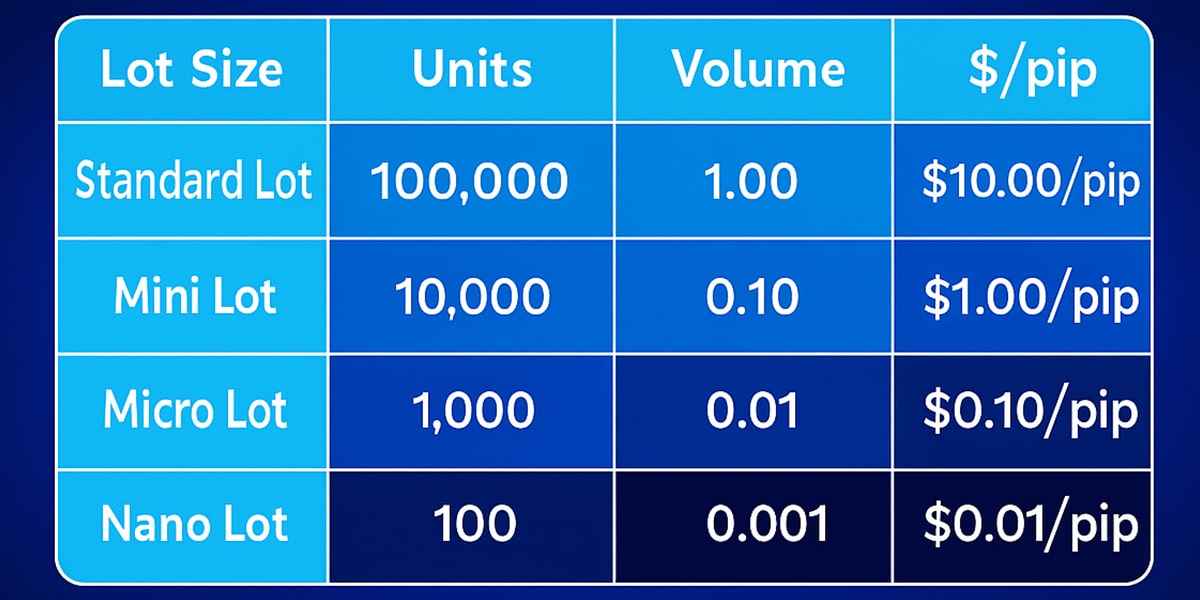

There are four basic sizes:

- ◆ The standard lot (1.0) - is 100,000 units. They are used by professionals with a lot of capital.

- ◆ Mini-lot (0.1) - 10,000 units. Suitable for deposits starting from $1,000.

- ◆ Micro-lot (0.01) - 1,000 units. The best option for beginners and deposits starting from $100.

- ◆ Nano-lot (0.001) - 100 units. More often on cent accounts — a good simulator without serious risks.

The smaller the lot, the lower the deposit burden. Experienced traders recommend starting with a micro or nano lot until the strategy is worked out.

How to calculate the lot size on Forex

The lot size is determined through the risk per trade and the value of the item.

Direct quotation (for example, EUR/USD)

- ◈ 1 point for 1 lot = $10.

- ◈ At 0.1 lots = $1.

- ◈ At 0.01 lots = $0.1.

A back quote (for example USD/JPY)

The cost of the item depends on the exchange rate of the pair. For example, at a rate of 145 yen per dollar:

- ➛ 1 lot = ~$6.9 per item.

Cross-courses (for example EUR/GBP)

The payment is made using the dollar as an intermediate currency. It's easier to use the calculator in the terminal here.

Example:

- ✦ Deposit = $1,000.

- ✦ Risk per trade = 1% = $10.

- ✦ Stop loss = 50 points.

- ✦ The cost of the item should be $0.2.

- ✦ This means that the volume is 0.02 lots.

Basic risk management techniques

The lot is selected not "by eye", but according to the system.

- » A fixed lot. You always open with the same volume. Simple, but it doesn't take into account the risk.

- » A fixed percentage. The best option: risk = % from the deposit. For example, 1%.

- » Optimal risk (Kelly's model). A more aggressive approach takes into account the probability of winning and the profit/loss ratio.

- » A fixed proportion. The lot increases as the deposit grows.

An experienced trader always works through a fixed percentage, rather than guessing based on emotions.

Minimum and maximum lot sizes for brokers

- ◉ Minimum — 0.01, maximum — up to 100 lots (depends on the broker).

- ◉ Even 0.001 is available on cent accounts.

- ◉ The maximum is limited by the liquidity and the broker's rules.

Do not confuse the transaction volume with leverage — leverage only increases the available lot, but does not eliminate the risk.

Which lot is the best to use

Optimal is where the risk is less than 1-2% of the deposit.

Examples:

- ◆ Deposit $100 → lot 0.01, stop loss no more than 30-50 points.

- ◆ Deposit $1,000 → lot 0.05–0.1.

- ◆ Deposit $10,000 → you can work with 1 standard lot, but more often they take 0.5 to control the risk.

An experienced trader always looks not at the possible profit, but at the acceptable drawdown.

Factors influencing the choice of lot size

- ◈ The amount of the deposit. The smaller the bill, the more careful the lot should be.

- ◈ Trading style. The scalper takes a smaller stop, which means that a larger lot can be allowed. A swing trader with large stops reduces the lot.

- ◈ The volatility of the instrument. The pound/yen "jumps" more than the euro/dollar, which means we reduce the lot.

- ◈ Personal attitude to risk. Some people calmly tolerate a drawdown of 10%, while others are nervous already at 2%.

Equity and lot size

The larger the lot, the faster the equity fluctuations.

Equity = balance + floating profit/loss.

If the deposit is $1,000 and you are trading 1 lot, then a movement of 10 points = ± $100. This = 10% deposit in a couple of minutes.

A large lot turns trading into a casino. A small lot makes trading stable and predictable.

Lots in other markets

- ➛ The stock market. Lot = a block of shares (usually 100). By purchasing 1 lot of Apple, you own 100 shares.

- ➛ Futures. The lot is fixed by the exchange (for example, 1 oil contract = 1,000 barrels).

- ➛ Options. The contract often covers 100 shares.

- ➛ Cryptocurrencies. Here you can buy fractional volumes (0.01 BTC, etc.), the lot is conditional.

Practice: lot installation in MT4 and MT5

- ✓ Open the new order window.

- ✓ In the "Volume" field, specify the lot size (for example 0.05).

- ✓ Set a stop loss and take profit.

- ✓ Confirm the transaction.

Tip: always check the margin. If the system does not allow you to open a deal, it means that the lot is too large for your deposit and leverage.

Calculation example

- ✦ Deposit of $1,000

- ✦ Risk: 1% = $10

- ✦ Stop loss: 50 points

- ✦ Item price = $0.2

- ✦ Suitable volume: 0.02 lots

This means that with a 50-point stop, you will lose $10, and with a 100-point take, you will earn $20. The ratio of risk and profit is 1:2, which corresponds to the rules of risk management.

Typical mistakes when choosing a lot

Most beginners drain their deposit not because of strategy, but because of the wrong choice of transaction volume.

- » Trading without calculating the risk. Beginners open a deal "by eye" — 0.1, 0.5 or even 1 lot with a small deposit. As a result, one mistake = full drain.

- » Ignoring the stop loss. Without a stop, even a microlot can turn into a disaster if the market goes down by hundreds of points.

- » Greed and overpriced lots. An attempt to "disperse the deposit" is a direct way to a margin call. The lot should grow with the deposit, not with the desire to earn faster.

- » Averaging without a system. The trader opens several deals with an increasing lot, hoping for a reversal. The market easily carries away the entire deposit.

- » Transfer of stock logic to Forex. Some people think that 1 lot on Forex = 1 share or "a little bit". In fact, this is a huge amount, and without understanding the risk, it is disastrous.

- » A forgotten calculator. Experienced traders always count lots through risk management or use the built-in calculator in the terminal. Newbies rarely spend 30 seconds calculating — and pay with a deposit.

- » The right lot is not about profit, but about survival. Professionals think first of all about how much they are willing to lose, and not about how much they will earn.

Trader's checklist for choosing a lot

Ask yourself these questions before each trade. If all the answers are "yes", the lot size is selected correctly.

- ✓ I have determined the risk of the transaction in advance (no more than 1-2% of the deposit).

- ✓ I have calculated the cost of the item for the selected volume.

- ✓ My stop loss follows the rules of the strategy and does not exceed the acceptable risk.

- ✓ I have verified that the deposit will withstand a drawdown even with a series of losing trades.

- ✓ I use a lot calculator or formula, rather than setting the volume "by eye".

- ✓ The lot corresponds to my trading style (scalping, swing, long-term).

- ✓ I don't increase the lot just because I want to make money faster.

This checklist is a simple insurance policy against typical mistakes. Experienced traders run it through their minds automatically before each trade.

Life hacks for choosing a lot

Practical techniques that are really used by experienced traders.

- ✓ Fractions are divided mentally into 100 parts. If the deposit is $1000, then 1% = $10. This is your maximum risk on the deal.

- ✓ Remember the cost of the item for your style. For example, for EUR/USD with a lot of 0.1 — $1 per item. This saves time on calculations.

- ✓ Use cent accounts for training. You can trade nanolots on them and practice risk management without pain for the deposit.

- ✓ Keep a lot calculator handy. Most brokers and terminals (MT4/MT5) have a built—in tool, and the mobile versions are even faster.

- ✓ Automate it. Expert Advisors and scripts can automatically set a lot for a given risk. It removes emotions and mistakes.

- ✓ Do not increase the lot after a loss. It is better to temporarily reduce it — it psychologically relieves and helps to survive the drawdown.

- ✓ Link the lot to the volatility. The larger the daily range of the pair, the smaller the lot. For example, always charge less for GBP/JPY than for EUR/USD.

Life hacks are simple, but it's these little things that separate a beginner who drains from a trader who consistently keeps a deposit in the black.

Conclusion

A lot is a risk control tool, not a way to "double your deposit."

Choosing the right position size is a key skill of a trader. Large lots lead to rapid drawdowns and margin calls. Small — they give time for the system to show its statistics and results.

An experienced trader always answers simply: consider the risk first, then the lot. And only then click "Buy" or "Sell".

FAQ

- ✦ How much does one lot cost?

Approximately $100,000 in the base currency.

- ✦ How many lots can you trade with a $100 deposit?

With such a deposit, it is wise to use only micro lots (0.01). Any attempt to open 0.1 or higher will lead to a rapid drawdown.

- ✦ What does the lot size 0.01 mean?

This is a microlot of 1,000 units of the base currency. On EUR/USD, the cost of one point is approximately $0.10.

- ✦ What is the size of the nano lot?

0.001 is 100 units of the base currency. It is almost not found on standard accounts, but it is on cent accounts.

- ✦ Why do I need a lot size calculator?

To calculate the transaction volume quickly and without errors depending on the deposit and stop loss.

- ✦ Is it possible to change the lot in an open transaction?

No, you can't change the position size. You can only close a part of the deal (partial closing) or open an additional position.

- ✦ Which lot should I choose for scalping?

For scalping, it is important to limit the loss on a short move. Therefore, 0.01–0.05 is usually used, even with a decent deposit.

- ✦ Is there a universal lot size?

No. It all depends on the deposit, the risk of the transaction and the chosen strategy. For conservative trading — minimum lots, for aggressive — larger, but always with risk control.

- ✦ Is it possible to open a deal in different lots at once?

Yes, you can open multiple positions on the same pair with different lots. This is called a partial build-up of the position. But the total risk still needs to be counted in total.

- ✦ Is lot and shoulder the same thing?

No.

A lot is the volume of a transaction, and leverage is a tool that allows you to open this volume with a small deposit. The lot determines the risk, the leverage determines the availability of the transaction.

- ✦ How to increase the lot correctly when the deposit grows?

Gradually, by no more than 10-20% of the previous level. For example, if you used to trade from 0.02, after doubling the deposit amount, you can raise it to 0.03-0.04, but not immediately to 0.1.